Best Cryptocurrency Trading Indicators

I recall when I first started trading in cryptocurrencies—I was a boy in a candy store, and coins seemed to jump out at me wherever I’d go, and each one seemed to have its opportunity at being “the one.” Before long, I discovered guesswork wasn’t working in such a scenario. That’s when I started studying trading indicators in depth. By “indicators,” I mean expert tools for processing information in the marketplace—picture them as a compass when hiking through new woods. If trading for real, you’ll have them in your pocketbook.

Here’s why they’re such a big part of trading for real. Cryptocurrency markets are moving at lightspeed, and a rumor can blow prices through the roof or down in an hour, an hour and a half, or even a minute. With no guiding system, becoming mired in the muck is simple. Indicators give a guiding system and paint a picture of whether a market’s trending, trending down, or simply moving sideways in a range-bound manner. It can detect overbought and oversold, a key consideration when deciding to enter a position or sit out a move.

I’ve played with many indicators—known ones and lesser-known ones—and have discovered most work best when grouped in an assortment. In terms of a superhero team, each player (or indicator) possesses its superability. For one, a trend indicator could have overall direction, and a momentum indicator could have the intensity of movement. One can confirm one’s cues by employing several, making getting blindsided less likely.

I also want to mention the human touch. Indicators are excellent, but they’re not clairvoyant. They won’t warn you of an unforeseen crackdown in a particular country, a tweet about a technology giant that sends markets into a tizzy, etc. That’s when your individual touch comes in. Through years of trading, I’ve developed my listening skills to charts and the news. An indicator will blurt out a bullish signal, but I proceed cautiously if I catch a whiff of impending nasty news.

Are you looking for the best trading indicators for cryptocurrencies? It’s worth remembering your trading personality. Do you have a high-flying, heart-pounding, I’m-only-playing-these-shorts-for-a-few-minutes kind of personality? In that case, you can rely a little less on momentum and volume gauges and a little more on momentum and volume gauges. Do you swing for days, even months, and ride trends? Well, then, your moving averages and other long-term trend statistics will power your trading arsenal.

Either way, I’d share one tip with any trader: never stop experimenting. That’s one of the best things about cryptocurrency trading: it’s relatively new, and new tools and techniques regularly appear on the radar. Even mature indicators can be optimized. You’ll employ a new Relative Strength Index (RSI) setting for lesser-known coins or MACD with a volume oscillator in a configuration no one else has tried.

Before I wrap up this section, I’d leave one final point: indications must work for your trading ideology, not drive it. Set a strategy that works for yourself—one that works with your tolerance for risk, your schedule, and your aims. Then, use indications to confirm that strategy and verify and negate what your gut tells you. I have found that gut and technical analysis bring steadier success. After all, at its root, a trade is a human conclusion, which means that the best tool, in the long run, is yourself.

Learning About Crypto Trading Indicators

The first time I entered the crypto world, I remember feeling overwhelmed by an ocean of plots, charts, and technical speak. I thought I was trying to learn a new language—”candlesticks,” “breakouts,” “Fibonacci retracements,” name them. But then I understood trading indications, and it was a cloud parting. I could make sense of all the madness at that stage. Indications became my interpreter, taking unprocessed, raw information about the marketplace and translating it into readable terms.

At a simple level, crypto trading indications are math recipes run with price, volume, or open interest data from the past. They report to us about future price activity that will likely occur. Some will report trends, some will track momentum, and others will target volume to assess investors’ enthusiasm for a move in a direction. All will use a different formula, but all are trying to answer one question: “Where is the marketplace moving?”

Now, the beauty of these indicators is that they’re adaptable. In my trading, you can use them over a range of timelines—from minute-by-minute scalp trading to monthly, even annual analysis. As a new entrant, you can begin with one simple one that comes naturally, such as a Moving Average, smoothing out price data to provide a general direction. As your confidence level grows, you’ll likely add a few additional ones to your chart, creating an “indicator stack.” That stack can be simple, complex, or whatever your heart wants.

One of the largest misconceptions about indicators is that they’re magical wands. I’m not afraid to admit I bought in early in my career. I’d see a buy sign in a specific tool, go headfirst, and then have the marketplace move counterintuitively. Over a few years, I realized that indicators represent one part of a larger picture. They don’t compensate for out-of-left-field news, emotion-fueled reactions, and manipulative big-player activity. You’ll still have to have your eyes and ears out for a more considerable marketplace nuance.

I saw value in changing settings for your indicators, too. Most have default settings—like the RSI at 14 periods—but those settings don’t have to be concrete. Certain coins and specific markets will respond to shorter, more extended periods. It takes testing and experimenting. For instance, you can have your RSI at 10 in a high-volatility environment in a coin and have a more accurate picture of its near-term moves.

Another crucial point to understand is that indications can both lag and lead. Lagging indications, for instance, such as moving averages, confirm trends when they have begun. They can work beautifully for a long move but will miss rapid reversals. Lead indications, such as Stochastic Oscillator, or RSI, attempt to foretell future reverses even before having occurred, but with a high probability for spurious warnings. In practice, I use a combination of both—leading indications to pick early shifts and lagging indications to confirm a trend’s strength.

One of my most liked aspects of delving deeper with indications is opening doors to high-tech trading strategies. As your confidence level matures, you can experiment with techniques such as divergence, in which the price moves in one direction. Still, an indication is moving in a contrasting direction. That can be a strong sign of an ongoing trend in its demise. You can also master reading crossing indications, such as when the MACD line crosses over or under the sign line. All of these types can work as an early alarm, alerting you about a trend about to stop or about to begin.

Sometimes, I’d prefer to picture each one of them in a boardroom: the trend one is the big-picture, conservatively thinking one, the momentum one is the impulsive buddy who’s ever looking for the big swing, and the volume one is the down-to-earth one who sees who’s getting in and out with everyone else in the current move. When all these “people” agree, I trust in my moves. And when not, I have to go deeper and sit out and wait for a little more to become apparent.

Lastly, remember, remember, remember: the marketplace isn’t static. An indicator that works beautifully in a trending environment will tank in a churning one. I believe in constant studying and continuous practice through ongoing learning. Journal your trading activity. Write down which tools produced reliable cues and which failed to deliver. Over a span, your gut will develop a knack for knowing when to trust and when to trust not. Briefly, understanding your trading indicators is reading your marketplace’s personality. Tuning into your marketplace’s radio station, when you tune in to the correct one, your cues arrive loud and clear. Naturally, a slight static will sometimes enter your ear, but with practice, your ear will become attuned, and you will sort out the din and understand the melody. And when you have faith, are knowledgeable, and have a lot better chance in a dizzying marketplace, that’s for darn tootin’!

What Are Crypto Trading Indicators?

Crypto trading indicators are algorithms, or mathematical formulas, that use price and volume in the past, plug them into mathematical computations, and then spew out graphical indications onto your chart. There are many forms they can take: lines moving between specific values, bands that enclose price, and even changing-colored histograms over some time. Whatever shape whatever form, they’re all attempting to exploit past information to make future guesses easier for you to make.

From my experiences, I have discovered that when you understand the “why” of these indicators, your use of them will become easier. For instance, a Moving Average takes an average price over a group of a specific number of periods in an attempt to level out price fluctuations over shorter-term trading horizons. It’s similar to taking an average performance over a group of runs in a car to gauge its overall distance traveled, not one single trip when it happened to run through a lot of traffic. Conversely, tools such as the RSI monitor how rapidly the price moves, offering an awareness of whether a coin is overbought or oversold.

The best part about them is that any form of trading can utilize them: scalpers, swing traders, long-term investors—anybody can capitalize on them. I prefer taking a small collection of them and having them corroborate one another’s messages. For instance, when my RSI reports about a market being oversold and my MACD reports a bullish crossover, that’s a one-two punch that I pay a lot of attention to.

But don’t forget, indicators don’t have a crystal ball. They work with past data; therefore, they’re a beat behind what’s taking place in the current price action. That’s why I’m not all in; it’s simply because an indicator told me to. I counterbalance that with fundamentals, market emotion, and my tolerance for taking a loss. Ultimately, an indicator is a guiding star that helps map your path and drive yourself.

Why They’re Important

I’m not being coy with you: the crypto marketplace can go bonkers. Prices swing in both directions in double-digit percentages in a matter of a few hours; a rumor can start a stampede, and even a rumor can have speculators fleeing for cover. Having something to stand on is significant in an environment such as that. That’s when an indicator comes in. Indicators matter because they present a structure and a fact-based view when everything else seems wacky.

To start with, indicators remove a lot of emotion from trading. I remember during my early days in my trading career when I’d allow my actions to be guided by my gut and feelings. I’d sell when a marketplace crashed overnight and run in when a coin took off, afraid I’d miss out. Most times, I’d burn my fingers with these gut instinct plays. Indicators helped me have a less emotion-charged view, a reminder to view the big picture, not my gut instinct.

Another key fact is that you can perceive opportunity with indicators when it’s not mainstream. Let’s say a coin’s been trading sideways for a week or two. All at once, a volume-based indicator is trending upward, and more buyers are getting in. That could be your early sign that something’s a-brewin’—a potential breakout. You could have been brought into position when your mainstream sources started sniffing out.

Indicators work marvels for managing your risk, too. Many traders brag about stop-loss orders, but nobody ever mentions how they choose stop locations. Volatility gauges such as Bollinger Bands can give an approximation of a coin’s general price range and then allow you to position stops in not-too-tight (which will yield early stop-outs) and not-too-loose (which will yield gargantuan drawdowns) locations. I have saved my skin a dozen times by using such gauges to make my stop positioning smart.

And then, of course, there’s one of my pet favorites about indicators: discovering hidden divergences—situations in which the price forms a higher high, but your indicator forms a lower high, and vice versa. Often, these represent warnings that a current trend is in its dying days and about to reverse direction. Without an indicator, such nuance can go undetected with your naked eye. In my book, following such divergences has proven a real game-changer. It sends me warnings about the impending top and bottom forms long in anticipation of your average follower in a coin’s community ever knowing it’s happening.

Finally, indicators impart discipline. It’s easy enough to switch between methodologies—one day trending, then mean reverting—but it’s not that simple when your heart is sore with a loss. With a group of reliable indicators, one must follow a script. Sit and wait for cues, confirm them, and then act. That kind of discipline can mean success and failure over a long run of years.

So, then, are indicators trading’s holy grail? Not even close. There’ll be mistakes; sometimes, even a seasoned player can get blindsided with a move in a most unfortunate direction. But indicators can act as powerful tools that allow one to ride out a storm, preserve one’s wits, and make less seat-of-the-pants and much less emotion trading.

Best Cryptocurrency Trading Indicators

What are the best trading indicators for cryptocurrencies? There’s no one answer for everyone. What will work best for you will depend on your trading style, coin, and willingness to sit in front of a computer monitor for a long time. That being said, a few consistently appear in a trader’s arsenal and for a reason.

The first group is the moving average (MA). Simple, exponential, weighted—name your poison, but whatever form, its function is to smooth out price information in an attempt to reveal the general direction. Most use a combination of a short-term and a long-term moving average and track a crossover, forecasting a potential direction change for a coin’s trend. It’s like driving down a highway and seeing cars merge: merge points will inform whether traffic will slow down or quicken.

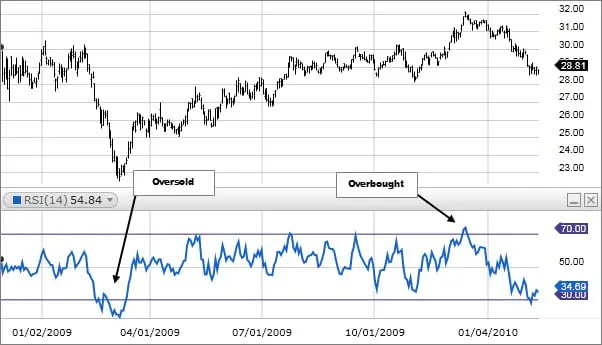

Next up is the Relative Strength Index, or RSI (you can use whatever name works best for your purpose!). A 100 to 0 oscillator tells you about overbought and oversold stocks. It’s not flawless, I’ll admit, but it’s a real lifesaver when I see it fall below 30 (signs of undervaluation?) or climb over 70 (a potential pullback!). I even use the RSI to grab a coin at a bargain price, only for it to go off and fly through the roof!

The MACD (Moving Average Convergence Divergence) is a similar fan favorite. It is best for seeing momentum turns and potential turns in trends. When MACD’s moving average line jumps over its signal line, a bullish move could soon be in your future; when it dips below, a bear move could be in your future, too. With volumes, MACD crossovers can make surprisingly effective entries and exits.

And then, of course, there’s Bollinger Bands for a reading of volatility. Plotting upper and lower bands over a moving average shows when price “bands” narrow and expand and when times of low and high volatility prevail. Narrow bands often forewarn big breakouts—think of a spring winding and then springing free!

Every one of these tools works for a specific purpose, and the key is discovering what mix works for your trading style. Some fanatics swear only for one, two, three, and then everyone else with a dozen stuffed onto a single chart (I shudder at even contemplating it!). My thinking? Begin simple, learn a two, and then gradually build your arsenal. It’s about discovering that sweet spot in between when your tools work together and harmonize with your overall trading ideology.

Technical Indicators: Moving Averages, RSI, MACD, and Others

I recall when I first understood the inner workings of technical indicators, and I felt I’d cracked a coded language understood only by an insider’s clique. In reality, these tools lay in plain view, and one can decode them with a willingness to sit down and study them. Some of them, in fact, are amongst the most simple ones, such as Moving Averages, RSI, and MACD, but then comes a whole lot else when one delves deeper.

Moving Averages

We begin with Moving Averages (MA). There is a variety of them—Simple (SMA), Exponential (EMA), and Weighted (WMA)—but all try to smooth out price fluctuations over a period of days in an attempt to reveal the actual direction of a trend. An SMA takes a moving average of closing price over a period (e.g., 50 days) and reflects a simple picture of direction in the marketplace. The EMA, in contrast, puts a more significant weight on newer price information and will respond even more to shorter-term price fluctuations.

The most widespread use of an MA is a simple crossover technique, in which one looks at a short-term MA (e.g., 50-day) and a long-term one (e.g., 200-day). As soon as a shorter one overlaps a long one, it’s bullish, a “golden cross.” Cross below, and it’s a “death cross,” and that can mean bearish pressure. I’ve taken recourse in these overlaps for a reality check, particularly when holding a position long-term or closing one out in anticipation of a downtrend getting out of hand.

RSI (Relative Strength Index)

Next up is the RSI, which compares price acceleration and deceleration to gauge overbought and oversold values. The RSI is drawn between 0 and 100; generally, over 70 is overbought, and under 30 is oversold. A little tip I have heard: Many traders fiddle with these values to 80 and 20 to counteract spurious signals, particularly in hyper-volatile crypto environments.

What I most value about the RSI is its ability to reveal divergences. For example, when the price prints a new high, but its supporting RSI doesn’t break through its high, that’s a bearish divergence, which can mean its uptrend is in danger of collapsing. On the other hand, a bullish divergence is when the price prints a new low, but its supporting RSI prints a new high. It’s a mixed message: the price says “down,” but RSI says “wait a minute.” I have captured a lot of memorable turns with my eyes glued to these divergences.

MACD (Moving Average Convergence Divergence)

The MACD can sound intimidating but comprises two moving averages (a quick EMA and a slow EMA). The space between these two MAs is drawn out in MACD form, and that MACD line is compared to a “signal line,” which is an average of MACD’s line in and of itself. When MACD’s line crosses over its signal line, it could mean bullish momentum; dropping below could mean bearish momentum. That little histogram that pokes out between MACD’s line and its signal line tells you about the vigor of this momentum change.

One aspect I have most appreciated is zero-line crossovers. Wherever MACD touches zero, it tends to mean that the shorter-term EMA has drawn out over the larger-term EMA—another bullish indicator. I have seen many traders make a whole trading system out of nothing but MACD crossovers, with variable success, I’m afraid. For me, MACD best works when used in a suite of tools, particularly when supplemented with RSI and even with tools for volumes, for that matter.

Going Beyond the Fundamentals

Moving Averages, RSI, and MACD form a “trinity” for many traders, but many additional technical tools deserve a tryout. A Stochastic Oscillator, similar to the RSI but with a marginally different calculation, tends to react more sensitively to price actions. The Commodity Channel Index (CCI) measures to what degree an asset price has deviated from its statistical mean—a valuable tool for sniffing out market extremes.

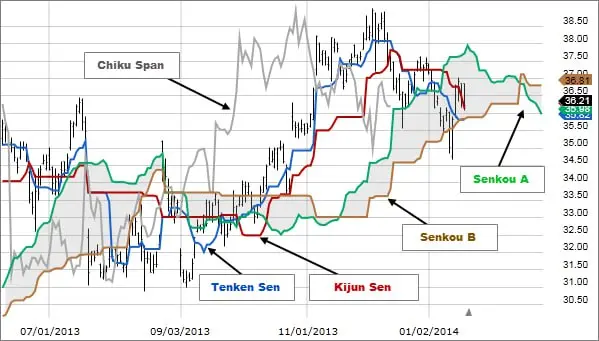

Another beauty is Ichimoku Kinko Hyo, which is not a single tool but a whole system offering information about direction, support, resistance, and momentum. Its cloud-like feature in plot form can at first be off-putting, but with an awareness of each constituent, it’s a powerful tool in your tool belt. I have used Ichimoku, particularly for breakouts and strong trends.

Practical Advice

One essential tip is not to overdo your chart with too many indications. As tempting as using everything from Stochastic RSI to Bollinger Bands is, you’ll most likely have information overload and nothing else. Instead, use a narrow range that works harmoniously with one another. For example, combining MACD with RSI can confirm momentum turns, and combining a Moving Average with a Bollinger Band could even better gauge volatility.

Remember to tune the settings for coin suitability and the timeframe in which one is trading. A 50-day MA can work for a big-cap coin such as Bitcoin, but for a whippy little altcoin, a shorter period that will react with alacrity could work best. The same goes for the RSI—traders swear by 14, but 9, even 7, works for them for added sensitivity.

Lastly, don’t forget that all these tools are looking in the rear-view mirror. Historical performance is no guarantee for future performance. Cryptocurrency is renowned for its unpredictability, and external events, such as releases in terms of regulators and even tweets, can override any technical configuration in seconds. That’s why it’s worth having an ear to the ground and an eye for the news and sentiment, combining fundamentals and technicals for a balanced view.

Volume-Based Indicators

Volume-based tools target the marketplace’s lifeblood: transaction activity. Where price tells one about where the marketplace’s been, volume tells how many bothered to buy and sell at such a price level. In crypto, with its whipcrack sell-offs and FOMO occurrences, knowing about volumes can mean the difference between getting in early and getting caught in a rip current.

One of the most famous gauges for volume is On-Balance Volume (OBV). OBV aggregates volumes when the price is trending up and rejects volumes when the price is trending down, creating a moving total trending in one direction. As long as OBV continues trending in approximately the same direction as the price, it’s an indication that buyers are entering; when the price is trending up, but OBV isn’t, then it’s an indication of weakness in the move.

Volume-weighted Average Price (VWAP) is a valuable tool. It’s a staple in traditional stock trading and even in cryptocurrencies. VWAP’s role is similar to that of a moving average but is weighted for volumes. It will yield a gauge for the “fair price” for some time. Anytime price trades above VWAP, a bullish bias could be in store; when below, a bearish bias could prevail.

I’m a big fan of tracking spikes in volumes. When a coin’s price spikes with high volumes, it’s an indication real dollars (no pun intended) stand behind the move. And when prices trend with low volumes, I’m suspicious—perhaps a pop-in price with little factual basis. I’ve even found I can use gauges for volumes in combination with gauges such as the RSI. For instance, when I have oversold readings in my RSI and see a spurt in volumes with a small pop in price, sometimes it can indicate that a more significant pop is in store.

Ultimately, volume-based gauges add nuance to price activity. They confirm or deny a breakout’s legitimacy. They reveal whether a move excites the marketplace or is merely a collection of big operators moving prices about. And in a marketplace, as emotion-charged as crypto, having that added level of assurance is worth its weight in gold.

Trend Indicators: ADX, Ichimoku Clouds, and Others

Trend gauges attempt to answer one simple question: “In which direction is the marketplace trending—and how strong is that direction?” In crypto, where overnight whipsaws have a talent for getting a tizzy in a trader, knowing direction can make your decision to join a party or sit out in a trading seat a little easier. Two of my go-to’s for finding and gauging trends include the Average Directional Index (ADX) and the Ichimoku Cloud system.

ADX (Average Directional Index)

The ADX most frequently plots a single line between 0 and 100, reporting information about a trend’s vigor, not its direction (contrary to most everyone’s guesses, it doesn’t report about an upward or a downtrend; it simply tells you whether a strong trend even exists). A reading over 25 tends to interpret a strong trending marketplace, and under 25 can mean sideways, a feeble, or no trend.

I like to combine the ADX with price action analysis or a secondary trend indicator to discern that we’re in a trend and in which direction it’s trending. For instance, when my moving averages are strong and upward, and my ADX is over 25, it’s a go-ahead for a bull move. As my ADX begins to fall, momentum could be waning.

Ichimoku Clouds

The Ichimoku Kinko Hyo can sometimes be called the “one-look equilibrium chart” to offer a single glance at trends, momentum, and potential support and resistance in one view. There are several components to the system: the Tenkan-sen (the conversion line), the Kijun-sen (the baseline), the Senkou Span A and B (which make up the cloud), and the Chikou Span (lagging line). At first glance, it can be intimidating, but when broken down, it’s no different than having a map that tells you where you’re at and reveals impending obstacles and refugees down the path.

I particularly enjoy using the “cloud” for its utility. If the price is in and above the cloud, we’re generally in a bullish country; below, it’s a little bearish. How thick (or thin) a cloud is can even inform how strong support or resistance could be. High walls, dense clouds, and thin ones can easily be broken through.

Other Trend Indicators

While ADX and Ichimoku make up the backbone of my toolbox, I have many additional trend tools worth checking out. Parabolic SAR, for one, plots below or above price to mark a potential change in trend direction. It’s a tad more proactive than a simple moving average and, therefore, can detect turns a tad early—but it can also produce a lot of whiffs in churning environments.

I use a similar tool, the Supertrend, a marriage of price and ATR (Average True Range). It plots a trailing stop line and changes direction when a change in the marketplace happens. I have seen it effectively used to ride out big moves in a tidy, trending market environment.

How to Apply

Be aware that trend tools function best in trending environments. In range-bound environments—popping between resistances and supports—trend tools can produce spurious readings. That’s why I have a quick scan at price action first in general terms. If everything’s trending sideways, perhaps it’s time to switch to mean reversion techniques or oscillator tools such as RSI, Stochastics, etc.

And, with a combination of a reading in trend tools and a reading in volumes or a momentum oscillator, spurious readings can be avoided, too. For one, when Ichimoku observes a bullish break out through a cloud but a puny volume, I will sit patiently and not yet enter. Conversely, when I have a strong reading in ADX and volumes start spooling, that’s my go-ahead to become more bullish with my entries.

In the long run, your guides will serve as your trend indicators. They will not guarantee your journey success but will enable you to gauge whether you’re swimming with or against a tide. By mastering reading and interpreting them, your odds of getting onto the correct side of a big move can go a long, long distance—something that can make a big difference in high-speed trading in crypto.

How to use trading indicators effectively

The magic of trading guides doesn’t entail plopping them onto a chart and hoping for a miracle but knowing when and why to use them and for what purpose. Effectiveness hinges on three factors: choosing guides about your trading style, knowing when to act in contradiction with conflicting indications, and practicing with discipline.

To begin with, choosing guides about your trading style is key. If your trading style is short-term, trading 5-minute charts and momentum oscillators like Stochastic and RSI will rank high for your needs. Moving averages and Ichimoku Clouds will serve your purpose as a position trader with a view over a week or a month. Hybridizing between two approaches can cause disorientation; therefore, choose your guides about your preferred timeframe.

Next, realize that sometimes your indications will and will disagree. Perhaps your RSI is yelling “oversold,” but your MACD lines have not yet crossed bullish. In such cases, use your expertise and general marketplace environment to make an educated guess. Sometimes, it will mean holding out for additional confirmation; sometimes, it will mean having faith in one over the other simply because it’s performed best for that specific coin or marketplace environment.

And don’t forget, discipline comes into play, too. Indicators are a tool, not a quick-fix scheme for getting wealthy quickly. Obey your script: don’t enter a position too early simply because you don’t want to miss out when your system tells you to enter when RSI is less than 30, and MACD crosses bullish, for instance. The inability to follow through consistently will kill you when effectively using your indications. By following your protocols consistently, you’ll be able to gauge what’s working and not working and fine-tune your strategy even more.

Most importantly, always remember to view the larger picture. Indicators represent past information and, therefore, can have no definite prediction value in the future. Supplement them with marketplace information, fundamentals, and a healthy portion of common sense. Pay attention to the news if a new, unanticipated, and possibly horrible development drops and your indications haven’t yet gotten in harmony. Successful trading combines information, gut, and discipline into one coherent scheme.

Integrating Several Indicators for Confirmatory Signals

If there’s one lesson I have learned over years of trading, putting your trust in one indicator alone is a gamble. It’s a little like deciding a life-changing move on one’s say-so—most probably, it will work out, but at least in part, you’ll have a gut feeling regarding alternative views. That’s why trading with several confirmatory indicators can drive your trading to a new level of success.

Here’s an oldie-but-goodie: let’s say you’re trading with MACD regarding momentum shifts, and it lights up with a bullish crossover. Your first instinct is to pounce immediately. But then a glance at the RSI reveals it’s at 80, overbought, and about to reverse. That bullish crossover doesn’t sound so sweet any longer—perhaps you’ll sit and let the RSI cool off first, then enter. That additional confirmation level (or hesitation) can save your bacon regarding impulsive mistakes.

A similar scenario can involve combining trend tools with tools focused on volume. Let’s say your Ichimoku chart reveals price breaking out through the cloud, a traditional bullish sign. But a glance at the On-Balance-Volume (OBV) shows it’s not moving in an upward direction—it’s not moving at all. That contradiction informs you that perhaps that breakout doesn’t have enough supporting volume, and therefore, you’ll enter a reduced position or even sit and wait for confirmation.

I use a trend indicator (e.g., EMA crossover), a momentum indicator (e.g., RSI), and a volume indicator (e.g., OBV). All three are in agreement that it is a perfect storm. Okay, that perfect storm doesn’t happen every single trading day, but when it happens, I have a lot of confidence in taking a trade. It’s psychologically comforting, too—if one fails for whatever reason, at least the other two have your back.

The biggest trap in using a combination of tools is not having them all say the same thing differently. Don’t overload your chart with five momentum tools, for example, and claim to have confirmation when, in reality, you have a lot of echo-chamber thinking. Instead, use diversity: a tool for following trends, a tool for following momentum, a tool for following volumes, and a tool for estimating volatility. That way, each tool can confirm a different aspect of behavior in the marketplace and give a three-dimensional view.

Risk Management Techniques

Trading is 20% strategy and 80% risk management. You can have the best indicators and the most sensitive awareness of the marketplace, but with no skill at managing your risk, you’re in Russian roulette with your money. For me, effective risk management starts with position sizing. No matter how ideal an opportunity looks, I don’t bet my whole farm on a single shot. By putting a mere 1-3% of my overall account at risk with each position, I insulate myself if I’m wrong.

Stop-loss orders are a pillar, too. Once I have my entry, I always decide how much I’m willing to lose on the position. That’s where I insert my stop-loss. If my position ends badly, I’m out of it before a loss spirals out of control. Yeah, I’m susceptible to a gap and getting filled at a less ideal price, but at least I’m not holding a position with no fall-back position in case I’m wrong about it.

Diversification is key, too. Cryptocurrency is a high-momentum marketplace, but that doesn’t mean you’re trading a single coin alone. By putting your bets over a range of assets—perhaps even venturing out of cryptocurrencies and into stocks or commodities—you mitigate the impact of a fall in any marketplace. Over the years, I’ve found that even in disparate cryptocurrencies, a few move inversely, at least in sympathy with one another. Splitting my bets between them smoothes out the ride.

Lastly, an emergency fund should be maintained in a safe base of assets, such as in fiat. It’s a no-brainer, but many a trader goes all-in. Things go wrong in life, markets can reverse quickly, and having a little in a haven can quiet your head. It will stop you from getting desperate and making poor choices when you are no longer in a position to lose any more than you have. Remember, steady profit is constructed in the shadow of steady risk management—without it, even the best scheme will boil down to havoc at best and catastrophic loss at worst.

“An often overlooked aspect of risk management is the selection of a cryptocurrency exchange with competitive fees. High transaction costs can significantly impact overall profitability. To make informed decisions, refer to our comprehensive guide on the Best Crypto Exchange With Lowest Fees.”

Timeframes and Market Conditions

I have learned that a brilliant scheme in a 1-hour timeframe will not work in a daily timeframe—or vice versa. Timeframes matter. 5-minute alerts can thrill a day trader, but swing traders prefer 4-hour or even a daily timeframe to detect larger, longer moves. I like to work on a top-down analysis for my portion. I’ll scan a daily or a weekly timeframe to understand a general direction and then work a shorter timeframe for entries and exits.

Market conditions matter a lot, too. Cryptocurrency experiences cycles—now and then, it’s a boom with a parabolic move and sometimes a sideways tedium. Indicators react differently in each cycle. Trend-following tools such as a Moving Average can rock in a bull move but generate whipsaws in a sideways move, and, in contrast, an oscillator such as RSI can dominate in a range-bound move but generate early warnings when a coin is on a tear.

Adaptability is paramount. If I’m reading that the marketplace is trading sideways, I’ll rely increasingly on mean reversion tools that will notify me when the price will correct towards a mean value. I’m reading about strong trend formation, and I’ll transition over to tools that confirm trend intensity and momentum, such as MACD or ADX. I’m tracking gauges for volatility, such as Bollinger Bands. Where bands constrict, a breakout’s in store; when bands widen, perhaps it’s a matter of taking a shot at safer trading methodologies.

The most critical consideration, in any case, is reading one’s environment in the marketplace. One will become poor and infuriated if one insists on taking one ploy in any scenario. By altering your indications, settings, and overall style to adapt to current realities, one’s more apt to win out. Sailing is a helpful metaphor: one doesn’t utilize the same ploy in calm seas as in a storm, correct?

Advanced Trading Strategies with Indicators

Once comfortable with simple setups and controlling one’s risk, one will most likely chafe at the desire for complex techniques. That’s when the real thrill sets in, at least for me. Complex techniques utilize a range of gauges, filter out marketplace white noise, and even include algorithmic tools for accuracy and efficiency.

For example, one such sophisticated move combines a momentum gauge with a gauge for volatility in the hope of snaring explosive moves in anticipation of them taking place. You follow your RSI for strong directional bias indications and Bollinger Bands for a volatility gauge. As long as your RSI is flashing a bullish move and your Bollinger Bands are tightening (a sign of low volatility), that’s a double whammy for a breakout about to occur. You enter your position exactly when the price pokes through a key level of resistance, and when correct, ride it for a tidy profit.

A sophisticated move is utilizing several timeframes in harmony with your preferred gauges. Your 4-hour MACD is flashing a bullish cross, but your daily chart’s RSI is in an overbought zone. Instead of ignoring such contradictions, sit and await your daily RSI to cool down or confirm that it’s reversing direction. That multifaceted technique allows for tightening your entry and exit in terms of aligning short-term with long-term trends.

Other professionals even search for harmonic structures such as Gartley or Butterfly and utilize gauges to confirm such sophisticated geometric price structures. While such structures can make for pretty pictures, in most cases, a secondary level of confirmation through oscillators or volumes must be followed to ensure that such structures represent nothing but squiggles in a sea of price motion.

Ultimately, advanced strategies involve stacking odds in your direction by combining various data points. They take a long time to learn and a lot of work to implement, but they have the potential for a larger win when executed effectively. Remember, though, that the more complex your strategy, the more thoroughly you must test it—either through testing in the past (backtesting) or in real-time with small position sizing. Complexity can be double-edged, and therefore, use it with caution.

“For traders interested in rapid, short-term trading approaches, the 1-minute scalping strategy offers a compelling method. Learn more in our article on The Best 1-Minute Scalping Strategy.”

Automated Trading and Algorithms

Picture yourself being able to replicate yourself and monitor the marketplace 24/7, trading at a split second’s opportunity, your requirements having been filled. That’s about what trading with automation can deliver. By encoding your rules in terms of your indications, you can outsource tedium to a bot. I recall when I first started with automation—like entering a trading future. But don’t make it sound too rosy and perfect; automation entails planning and maintenance down the line.

The big pay-off is in terms of both velocity and accuracy. With a well-written bot, no hesitation and no emotion will enter its decision. If your rules say, “Buy when below 30 and the price touches over 50-period EMA,” then your bot will do it no matter what, no questions asked. For a scalp player or high-freq player, this can significantly impact a fussy and unpredictable environment, such as in a high-volatility coin marketplace, where the opportunity arises and vanishes instantly.

However, automation comes with its dangers, too. One little bug in your code can reverse your strategy, entering random trades or doubling down when it shouldn’t. And then, naturally, market trends can change, and your bot won’t respond unless you have it programmed to respond to such a change. I update my algorithms for my algorithms about every three weeks, checking to make sure they’re working as planned. I sometimes have to fiddle with settings for my indicators; sometimes, I realize my strategy isn’t working under present market realities.

Another issue is latency—how long your bot can obtain and act on information in real-time. In high-speed crypto trading, a lag of a matter of seconds can mean a missed opportunity, a poor fill, or both. That’s why high-end professionals pay for VPS hosting near the exchange servers and sometimes even co-locate machines to shave seconds off of latency.

So, automated trading can be a powerful tool but not a set-it-and-forget-it tool. It’s similar to having a high-performance car: you can go much faster than most drivers, but you must drive with care and a sharp eye out for danger to not drive off a bridge, for instance. If and when you’re prepared to jump in, start small, run your tests over and over, and don’t be afraid to tinker non-stop to keep your bot current with an ever-changing crypto marketplace.

Backtesting Your Strategies

If there’s one tip I can yell off a rooftop, it’s that: Backtest your strategies first, then go live. I traded with a new idea, throwing it out into the marketplace and wishing for the best—too many times, with disastrous consequences. Backtesting saved my bacon. Backtesting enables you to visualize your strategy in terms of its performance under past conditions in a manner that allows you effectively to go back in time and try out your hypotheses with no dollars at risk.

Why Backtest?

Backtesting enables you to evaluate your trading strategy’s viability. That RSI-and-MACD crossover scheme actually performed in 2021, or have you seen what you hope to see in a selectively chosen few charts? By testing your rules with actual real-life data, you’ll soon enough know if your concept holds water or is mere fool’s gold.

And then, of course, backtesting can reveal drawdowns that can confront your system. Perhaps your system’s profitable in terms of overall performance but grinds through long stretches of losing trades. Having that in your awareness beforehand can make your mental preparation easier—so you don’t become tempted to give a sound system the boot when it runs through a rough stretch. In a real sense, backtesting can be part psychological preparation, part testing of your system.

How to Backtest

There are two general methodologies: computerized and manual. Manual backtesting involves actually working through older charts, jotting down each instance in which your conditions would have initiated a trade, and then noting the outcome. It is a time-consuming process, but at least it keeps one in tune with price action. A manual can be helpful for beginners, for it acquaints one with your strategy’s idiosyncratic behavior and quirks.

Computerized backtesting involves encoding your strategy in a platform capable of putting it into practice through a meaningful portion of history. It can save an enormous amount of time and allows one to try a variety of pairs, a variety of times, and a variety of sets of market conditions with a single button press (provided, of course, one can or one happens to have a developer at one’s disposal capable of, encoding). Computerized testing can disclose trends one will miss working out for oneself but with a curve. One must make one’s encoding accurately represent one’s strategy’s rules and exercise discretion regarding data quality—garbage in, garbage out, and all that.

Useful Metrics

Where, of course, profitability is the headliner, there are a variety of statistics worth noting. The win-loss ratio tells one about how many times one’s trades won and not, but tells no whole picture. One could have a 40% winner-only strategy and make a profit, for one’s winners, when won, are gargantuan in relation to one’s losers.

Drawdown is a big one, too. A 50% drawdown would mean your account would have been down in value by 50% at a specific point in time. That’s fine for some but not for everybody else. And then visualize your best sequence of successive drops—could you make it through 10 or 15 in a row?

Also, look at your average return per trade, average holding period, and activity level in terms of signals. Your system seems incredibly profitable on a sheet of paper but brings in only a single monthly, and that’s not your desired activity level. On the other hand, a system producing a lot can burn through fees trading at an exchange with high fee structures.

Overfitting and Curve Fitting

The largest trap in backtesting is overfitting. That’s when you fiddle with your strategy’s parameters enough to make them perfect for a stretch of specific past data, but in doing so, make them completely inept at dealing with new realities in a marketplace. It’s studying all questions in a practice examination; for instance, I’ll surely pass that examination, but any variation in real examination questions could put me in a loop.

To avoid overfitting, try testing over a range of times and pairs of currencies. That your system works for Bitcoin in 2020 alone is a sign of a problem. You could even split your older data into two: one for developing your system (in-sample) and one for checking afterward (out-of-sample). If your system works in both, then it’s probably strong enough to generalize.

Walk-Forward Analysis

If you insist on being thorough, try a walk-forward analysis. That’s when you grab a portion of historical data, tune your strategy’s parameters, then move down the timeline and see how the tuned parameters perform in the next portion of data—rinse and repeat. This is a better simulation of reality in that you’ll periodically update your parameters according to current market behavior.

Putting It All Together

Once you’ve backtested, you’ll better understand your strategy’s performance in real-life scenarios. But don’t forget, backtesting is only part of it. Forward testing, a.k.a. paper trading, is when you implement your strategy in real time with a practice account or a tiny portion of capital. That’s when you ensure your backtest wasn’t simply a one-time fluke of a sequence of historical events. Only once your tests in forward testing yield consistent performance can you start scaling up significantly.

In my own development, backtesting and follow-up testing helped me go from a shotgunning, unorganized trader to a more systematic one. I gained confidence knowing my strategy boasted a proven track record. And when I did encounter a run of losing trades, I could refer to my analysis of past performance, remember drawdowns were part of the bargain, and press on.

All in all, backtesting is similar to laying a strong base for a house. It won’t necessarily save your life when a storm comes, but it raises your chance of riding out the storm in one piece. Before plunging headfirst into a new strategy, spend a little time in the sandbox of backtesting. Trust me, it’s worth it.

Continuous Learning and Adaptation

If there’s one constant in cryptocurrencies, it’s change. There are new coins, new legislation, and emotion in the marketplace, swinging between ecstasy and agony in a matter of days. Sticking with a stubborn same-old, same-old routine that saw you through last year—or even last month—will have you in its wake. That’s why I believe continuous learning and adaptability must be key.

I prefer trading as an ongoing journey. Every single trade teaches you something: a profitable one confirms your strategy, and an unprofitable one reveals your weaknesses. Write down these lessons in a logbook—note your reason for entering, your guides, and what happened. Over time, trends will form, and your approaches can form through real-life testing.

Be not afraid to try new guides or even new sectors altogether. I started trading big coins such as Bitcoin and Ethereum but soon traded alts and even DeFi coins. Each niche had idiosyncrasies, and I had to adapt my guides and timeframe for them. Techniques effective for Bitcoin in the daily timeframe must be altered for alts in the hourly timeframe.

Education is a necessity, too. I regularly consume books and articles about technical analysis, risk management, and trading psychology. Online courses and webinars can be a goldmine of information—authenticate your sources. Twitter, Reddit, and specialist forums can pass real-time information, but exercise care to weed out a lot of hype and flumplenook

In short, don’t ever believe you have it all together. When you think the market is under your grasp, it will teach you a rude lesson. Stay inquisitive and adaptable, and view each trading session as an opportunity to sharpen your edge. That mental attitude helped me build and develop as a trader and is a necessity for long-term success.

Common Mistakes to Avoid

Mistakes will sometimes occur even with experienced traders, but a few mistakes repeat repeatedly—most notably in cryptocurrencies. On a positive note, most can be avoided when you know what to watch out for.

The biggest one is entering a position with no intention. I have seen people buy a coin at random simply because it’s trending on social media and sell in a state of panic a few trading sessions down the line when the price drops a little. Don’t use trading signals when you have no overall intention. Before entering any position, consider your stop-loss, target, and entry.

The most common one is chasing pumps. Cryptocurrency is full of hype pumps, and it’s simple to go in headfirst when a coin pumps 50% in one trading session. By then, you could buy near its high, with early birds lining up to sell out at a loss. Signals can say that the market is overbought, but if you ignore them out of greed, you’re in for disappointment.

Neglecting risk management is a killer, too. I can not over-emphasize enough about getting your position sizing and stop-losses in position. There isn’t any position that’s a guaranteed winner, and losing positions are part of trading. If you blow your entire account in one, two, or three losing positions, you won’t survive long enough to make out for the next opportunity.

And then, don’t forget the post-trade review. Most traders repeat and repeat the same mistakes over and over and over again simply because they don’t ever sit down and review what happened wrong. Were your indicators in error? Did you move your stop-loss for no reason? By analyzing your trades post-mortem, you’ll understand what to tweak in order not to repeat mistakes again. A trading journal can become your best buddy in such a scenario.

Overreliance on Indicators

Indicators can become a tremendous edge, but let’s face it: they’re not perfect. One trap I have seen many (including my early days in trading) fall into is an overreliance on indicators at the expense of everything else. It’s like driving a car with your eyes glued to gauges in the dash and not looking at what’s in front of you down the highway.

Overreliance tends to spring out of a desire for certainty. Crypto markets are a mess, and we crave anything that can give us a guaranteed edge. However, indicators, out of necessity, interpret information from the past and extrapolate it into the future. They can’t respond to unforeseen events, shifts in emotion, or even unforeseen events in the real world.

That’s why you combine a mix of indicators with a simple chart reading, fundamentals, and a little gut feeling that comes with years of trading. Sometimes your indicators will say “buy,” but your reading about a significant exchange getting compromised comes out in the press. Or your gut will say it doesn’t sit with me—perhaps price action is untypically whippy. In such times, taking a step back and rethinking can save your bank account from costly errors.

Loading too many indicators can produce information overload and conflicting messages. You can fall victim to “analysis paralysis,” with every one of your indicators sending a contradictory message, and in your indecision, you miss a trading opportunity altogether. A simple selection of tools, consistently applied, tends to beat a crowded chart with bells and whistles everywhere.

Lastly, indicators represent only one part of the big picture. They are best-regarded tools for your decision-making, not oracles for guaranteed success. Learn and use them, but don’t let them cloud your view of the big picture and your trading plan and dynamics.

Ignoring Market Fundamentals

I’ll admit I enjoy technical analysis. There’s a pleasure in reading a chart and allowing information to guide your actions. Yet, ignoring fundamentals is a blunder I have seen sink many a trader. In an environment such as crypto, events and news in real life can overpower even the most perfect sets of technicals in an instant.

Think about it: a coin can have a picture-perfect “bullish” chart arrangement. However, if its development team recently announced an update stating that they’re shutting down the project, that chart arrangement can fall apart in seconds. Regulatory crackdowns, partnership releases, network upgrades—these fundamentals can make and break a coin’s price. I recall trading a low-cap altcoin that seemed perfect in terms of its chart, but then it collapsed when investors heard that the development team fudged user growth statistics.

Of course, there’s community, adoption, and perception. Crypto projects rise and fall with communities. Even when your technicals indicate momentum is bullish, when a coin’s community is doubting, when a project’s fundamentals go into free fall, you’re fighting a losing battle in the long run. Conversely, a coin with healthy adoption, healthy partnerships, and a healthy community can regain its ground following a technical breakdown in less time than it takes to count!

So, I’m always tuned in for the pulse of the news. It’s not about reading every headline but knowing about significant events that can change the narrative in the marketplace. And no, I don’t have to be a fundamental analysis guru, but having a general awareness of a project’s development timeline, development team integrity, and general marketplace perception can go a long, long way in filtering out a trade that looks perfect in theory but isn’t sound in fundamentals.

The bottom line is that technicals say “how” a price behaves, and fundamentals say “why.” Forgetting about “why” can cause significant, big surprises—usually uncomfortable. So do yourself a favor: tune in to the news and significant releases, and remember that at the heart of every chart is a real-life narrative in motion.

Poor Risk Management

One that keeps me up at night is seeing a trader blow out an account for not practicing proper risk management. In a universe where double-digit percentage price moves in one day are not out of the ordinary, not planning for a worst-case scenario is equivalent to walking a high wire with no net below it.

Over-Leverage

The greatest transgression, in my book, is over-leverage. Margins and future trading can multiply your gain, no doubt, but multiply your loss. I have seen a 10x levered position taken in a “can’t miss” position, only for the price to move 10% in a direction not in your direction, wiping out your whole position. It breaks your heart, and it’s unnecessary to have a simple dial-back in leverages or not use them at all when you are not yet prepared for them.

Lack of Stop-Losses

The other most prevalent faux pas is not having stop-losses in position. It was the most leisurely trip ever, thinking, “I’ll monitor it.” Crypto doesn’t sleep, and neither can your protective protocols. Not being present to cancel a position when gone wrong can compound your loss in a big way in a short period. Stop-losses serve your first and best protection, getting out at a specific price, not holding onto a loss through its duration.

FOMO and Revenge Trading

Risk management is not a matter of maths but of psychology, too. Fear of Missing Out (FOMO) can have you in positions with no analysis and with larger, no less, positions than your comfort zone, and revenge trading, in a desperate try at “reclaiming” your losses through doubling down, can spiral out of your hands. Both habits circumvent the fundamentals of risk management and produce more significant and, increasingly, more losses. Discipline is the best antidote: instate protocols for position size and several positions in a period, then act them out.

Diversification

I can not over-emphasize enough that diversification is essential. Crypto is a roller coaster; any coin can blow sky high with a hack, a shutdown at regulators’ hands, or a simple unpredictable incident. By having your capital in a range of assets—even assets not in crypto—you can diffuse the blow in case one fails. Just ensure that your over-diversification doesn’t make it impossible for you to manage any one position effectively. Several high-quality, closely monitored positions tend to outperform a shotgunning strategy, in my book, at least!

Being Emotionally Prepared

Lastly, risk management is about preparing yourself psychologically, too. Even with a flawless plan, it can go wrong, and you can have a run of losing trades. What’s essential, then, is your reaction to it: Do you stand your ground and maintain your strategy, or go with a “suck it and see” attitude? By knowing your financial and psychological tolerance, you can position yourself appropriately and use stops that enable you to sleep at night, even when the market throws a tantrum.

Ultimately, inadequate risk management is a slow leak in a tire—you don’t even realize it at first, but at some point, it’ll leave your trading car in the ditch. Good risk management, on the other hand, is the rock-solid foundation for steady, long-term success. It won’t be as exciting as getting in early and predicting the next 10x coin, but it distinguishes professionals from the countless wannabes who blow in and out with the wind.

Cryptocurrency Trading Indicator Tools and Resources

Traveling through the crypto universe toolless is a lot like attempting to climb a mountain in a pair of flimsies—technically feasible, but you’re unnecessarily making life much more complicated than it should be. Thankfully, there’s an ever-expanding universe of platforms, communities, and educational tools to keep your head in the game.

To start, a dependable charting platform is a necessity. Software like TradingView offers an ease-of-use interface, a rich selection of inbuilt indicators, and the freedom to make your own custom script or utilize an imported one. Most larger exchanges have inbuilt charting, but I prefer a standalone platform for its freedom and dependability. It’s simple enough to have a coin comparison, switch between times, and even have an alert for when an indicator reaches a specific level.

Data aggregation websites like CoinMarketCap or CoinGecko are goldmines, too. They don’t report price alone; they report volume, market cap, and other statistics that can contribute to your evaluation of a project’s viability. In many cases, they’ll even have direct links to a project’s press releases, social channels, and website, allowing for an easy background check of fundamentals.

There’s no lack of video tutorials, articles, and courses online regarding tools. Many successful traders and analysts post their analysis on YouTube or through pay platforms like Udemy. While you must guard yourself against guaranteed profit promoters, such platforms can nevertheless be goldmines of real-life information—provided that you can find instructors who prioritize risk management and realism in their outlooks.

Lastly, don’t undervalue the value of networking. Reddit communities, Twitter, and even crypto forums can introduce you to seasoned professionals who have gone through your problem sets and can offer real-time guidance and encouragement. Participate, ask questions, and don’t shut your mind off, but remember that the crypto community is replete with hype, and don’t ever follow a fellow’s tip without first having performed your own work and checking your math.

Software and Platforms

The selection of software can make your trading life easier overall. I break this down for my use cases into three categories: charting software, trading robots, and portfolio trackers. I mentioned that TradingView is a standout for its feature set and social capabilities for charting. Not only can I follow other observers, see new script work, and even post my work for feedback, but I can even integrate with a whole universe of community-created analysis tools, including for free. Other software, such as Coinigy or MetaTrader (for specific crypto CFDs), have useful charting, but I have seen TradingView become a community platform.

If you’re trading with automation, you’ll prefer a platform that enables custom bot creation through coding or a marketplace through which one can purchase or lease pre-written strategies. Products such as 3Commas, Cryptohopper, and HaasOnline have a high following in this regard. Most utilize big exchanges through an API key and permit bot trading with specific rules depending on particular indicators. However, pilot and evaluate strategies first with real dollars at risk.

Portfolio trackers such as Blockfolio (now rebranded under the name FTX), Delta, and CoinStats will organize your life in case your assets are scattered across various exchanges and wallets. Apps enable real-time tracking of your assets with no individual logins for individual platforms. In a madhouse marketplace, it’s a godsend. I have saved my bacon various times by not missing out on significant sell orders and having immediate alerts delivered to my phone.

Regardless of software and platform, ensure it’s compatible with your overall trading scheme. For instance, as a swing trader with limited monthly buys and sells, a high-falutinhigh-falutin bot service isn’t in your best interest. On the contrary, if your model entails scalp trading alts in real-time, a high-fidelity, low-latency environment could become imperative. Ultimately, your ideal platform will simplify life for your trading and make your decision-making processes smarter.

Community and Educational Resources

Crypto can become a solitary activity when trading alone, but it doesn’t have to be that way. One of its greatest strengths is its rich, global community. As a newcomer, I discovered tremendous value in trading Telegram, Discord, and Reddit communities. Not only did I receive tips and information from experienced traders, but I also received motivation from my new friends.

Learning tools surround you. Twitter can be a big timesaver when following key personalities—analysts with shared charts, devs with dev posts, and breakers with timely sources of information. Just exercise care with a shilling and conduct your own investigation. Established traders’ YouTube channels can even provide free educational tools, ranging from simple walkthroughs of an indicator to complex trading psychology.

You could try paid courses and mentor programs for a more organized path. Some overpromise and underdeliver, even being scams, but a few will walk you through each step, beginning with reading your first chart and working through complex techniques. Look for transparency in both their record and ideology. Don’t trust anyone with promised wealth; run in the opposite direction.

Finally, don’t forget in-person events such as conferences or in-person meetups. As less common in today’s era, such events nevertheless occur. Meeting fellow traders in person can stimulate conversation that can’t happen in cyberspace. Whatever your meetup is, casual, relaxed meetup, or full-fledged expo, such events can introduce one to collaborations and grant direct access to information about your field through expert speakers. In a word, the crypto field is an information goldmine—tap in bright, and you’ll see yourself growing at an unimaginable pace in times gone by!

Conclusion

The crypto marketplace is exciting and unforgiving. In my journey from an ignorant newcomer to an experienced, wiser trader, I have found that the best trading indicators for crypto depend on your style, loss tolerance, and familiarity with your marketplace. Do you swear by moving averages, using indications derived from volumes, or enjoying complex information in Ichimoku Clouds? Remember, no one single indicator can ever function as a silver bullet. They’re tools, not clairvoyants.

But tools can function in capable hands. Learning to utilize a combination of several indications in a variety of timeframes and marketplace scenarios and understanding when and how to manage your wagers can make a big difference. This isn’t a one-time skillset kind of activity. A new range of indications, trends, and technology are in development. To remain current, one must learn, run tests periodically, and not resist changing when a tool no longer works for him.

Above all, trading is about your objectives, personality, and financial position. Remember, what I have communicated regarding techniques and indications is a model, not a script. Try, make a note, adapt, and repeat. That’s an improvement, one trade at a time.

I’m Mahdi, founder of 1minscalper.com, and I hope, in earnest, that careful analysis of trading indications will make your journey through the exciting—but sometimes turbulent—sea of crypto easier and less daunting. Wishing your charts to be transparent, your indications strong, and your earnings ever-growing