The Best 1-Minute Scalping Strategy to in Trading Crypto

Welcome to “1minscalper“, I am Mahdi. If you are like me, then the smell of quick profits from trading gets your motor running. So, today I shall delve deep into the best 1-minute scalping strategy-the Holy Grail for traders hungry for speed and efficiency. In this guide, find lots of actionable tips and insights whether you are an amateur or expert trader that can be incorporated into your style of trading to increase profitability.

Introduction: Why Scalping Could Be Your Key to Success

While living and trading in this fast and, at times, erratic world, less is really more. By distilling your approach down to clearly defined strategies and well-managed risks, you can face the markets with confidence, secure in the knowledge that the best decisions are being made for your trading goals. That is precisely what one gets from the 1-minute scalping strategy. I had liked the pace of the scalping right from the very first moment I came upon it. As opposed to having to wait for days, or even hours, for the trades to complete, with Scalping, a trader could cash in on fast market movements.

It’s a high-stakes game where each second counts; you do not need an enormous bankroll to get moving. Well, what is scalping, then? In plain words, this is a trading strategy dealing with a great number of small trades within one day. Each of these trades lasts several seconds or a couple of minutes and is aimed at catching a tiny price change.

This is like gathering the pennies from the ground-you don’t need the jackpot, but these pennies grow really fast once you manage to collect enough of them. Scalping is attractive because of the speed at which it delivers returns. Unlike swing trading or investing, where you might have to wait weeks for your returns, this offers immediate results. It’s ideal for traders who love action and can remain focused in very short bursts of time. But let’s be realistic-scalping isn’t for everybody.

It takes discipline, fast decisions, and a good market understanding. You may wonder if anyone can scalp. Indeed, whether you’re starting waters or an advanced trader wanting to add another tool to your utility belt, Scalping can be done by you. It all comes down to planning and equipping themselves with the necessary tools and plans to make it happen. In this book, you will be given a practical approach; it will also be divided into several chapters for you to follow.

Of course, there is more to explore; for example, the best area that serves well for highly volatile trade is in highly liquid markets. These include the forex, stock, and cryptocurrencies, whose movements are dynamic, hence giving numerous chances for a scalper to make their money. But in the same way, they can be volatile, and if you are not strategic enough, you can lose a lot of money as well. Because of this factor, risk management forms one of the essential features for a scalper to be successful. One of the most significant advantages of Scalping is that it avoids overnight risks.

Because all of your trades are closed in minutes, you don’t have to worry about market gaps caused by news events while you sleep. That makes this a good option for traders who like hands-on trading and hate having to be with uncertainty overnight. Of course, not all is rosy in this business. As usual, like any other business model, there are those obstacles to be overcome in Scalping: high transaction costs eating into your profits in the case of an expensive broker, not to mention fast action in scalping that might be quite stressful-especially for new entrants.

But with proper strategy and tools, this could be managed. So, why read on? Well, I’m about to show you how to master 1-minute Scalping, from the tools and indicators you need to proven strategies and tips on risk management. This guide covers it all so that by the end, you will have a clear plan with which to start confident and profitable Scalping. Let’s dive in and explore this exciting world of 1-minute Scalping!

What is 1-Minute Scalping?

1 minutes scalping: Let’s examine the details of 1-minute scalping step by step to comprehend this influential trading strategy fully.

Step 1: Understanding the Concept

At its very core, 1-minute Scalping involves executing trades in a minute to capture small price movements. Traders do not wait for big movements; instead, they simply scalp on minor fluctuations of the market. The operative word here is speed, which refers to both Execution and decision-making.

Scalping relies on the concept of market fluctuation, even within the tightest time frames. With such targets, traders can realize gains rather fast without being in the markets for a long time. It is largely a strategy relying more on technical indicators and patterns rather than on fundamental analysis compared to other long-term strategies.

One important component of Scalping involves discipline. With trades happening very fast, little time remains to question oneself or even to doubt whether to get in or not. Timing is everything, and even the shortest delay could turn an otherwise winning trade into a loser. For this reason, traders rely on predefined entry and exit techniques to reduce risk while maximizing returns.

Step 2: Setting Up Your Trading Platform

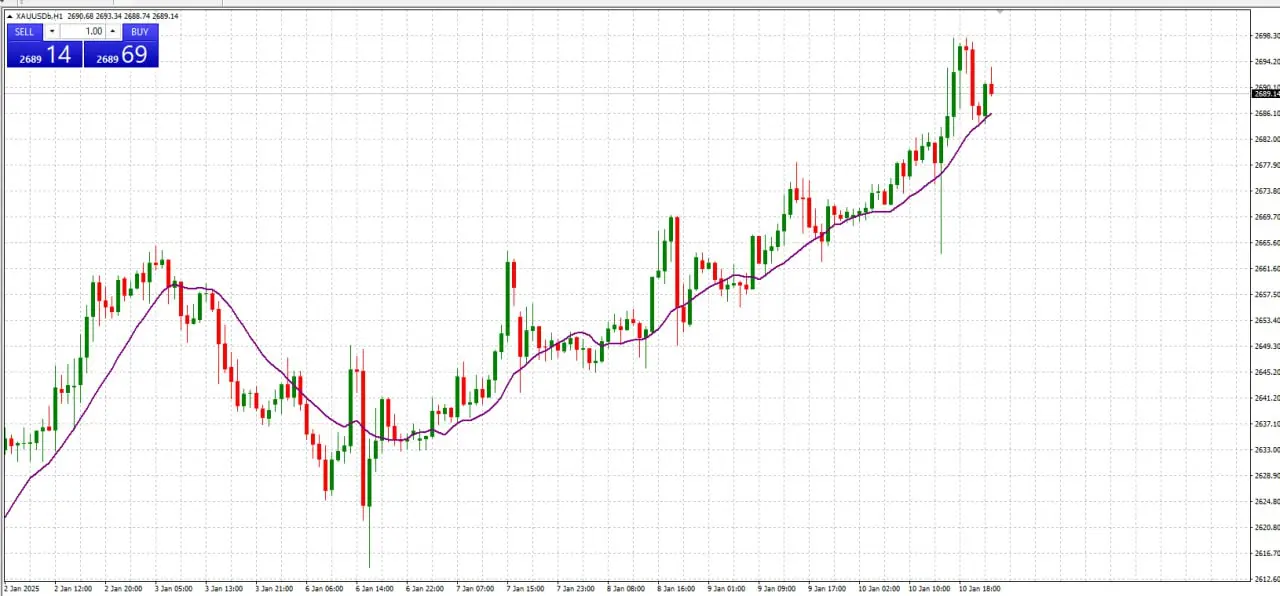

To effectively apply this strategy, you’ll want a robust trading platform that can deliver you real-time price data with fast order execution and fully customizable charts. You’ll then be able to set up your moving averages, RSI, and Bollinger Bands to track trends and spot opportunities in seconds.

Modern trading platforms incorporate tools that are integral to finding success in Scalping. For example, MetaTrader 4 and 5 are popular among this type of trader because intuitive interfaces offer extensive charting capabilities. A trader may set up many charts containing technical indicators while even automating parts of a strategy using Expert Advisors, or EAs.

Another important feature is support for hotkeys, which enables instant Execution of trades. In Scalping, decisions come in split seconds, and at times, they cannot be achieved with mere clicks of the mouse. This will help you open, adjust, and close positions instantly without delay.

Step 3: Entry and Exit Points

Success in Scalping means precision. Enter a trade based on breakout points, trend reversals, or support and resistance levels. You can combine indicators to confirm the signals and then exit once your profit target, usually just a few pips, is reached.

Indicators help identify profitable opportunities. A moving average crossover can pinpoint the start of a trend, while RSI levels above 70 or below 30 would signal overbought or oversold conditions, respectively. Combining such indicators increases one’s chances of success with a trade.

Step 4: Risk and Capital Management

Because Scalping requires so many trades, it is not possible to skip risk management. Place tight stop-loss orders to save your capital and avoid over-leveraging. Focus on consistency instead of big wins to build up sustainable profits.

A good strategy is the 1:1 or 2:1 risk-to-reward ratio. For every trade, be sure to decide how much you’re going to risk compared to how much you need to gain. That means you are not going to enable one huge loss to destroy a number of small profits.

Best Scalping: How to Master 1 Minute Scalping to Success

Scalping in trading refers to a specific methodology of trading whereby traders try to profit from the tiny price movements of security within the shortest period possible. The 1-minute scalping approach has become one of the most popular in the arena because it will be able to give speedy profits, but learning how to use it correctly can make a substantial difference towards any trader’s intentions of shining brightly in such a fast-moving market setting.

The 1-minute scalping involves opening trades on minute charts, trying to take small fluctuations of prices. Though it may sound so simple, precision, speed in decision-making, and correct tools make the difference. Besides, among the most vital things one should always consider in this area is market liquidity. A highly liquid market would have a tight spread and fast execution-something each scalper will want to have if he hopes to get in and out in the shortest time possible.

While preparing traders to head up and control 1-minute scalping, it’s going to be important to limit them to specific indicators that can create fast yet safe signals. Those would involve the MA Crossover Strategy- to find very short-term trends- and the Relative Strength Index- to find out about overbought and oversold levels. Integrating those with a decent risk management system can help avoid those super losses, usually by setting a close stop loss in place and only an average-sized take-profit goal.

While choosing the right approach, one should choose the right platform. A 1-minute scalp will likely demand a trading platform that can provide high speed and low latency. Among the very best platforms for 1-minute scalping is MEXC. It offers a very user-friendly interface, swift execution of orders, and a wide variety of trading pairs. All these features make it an ideal platform for scalpers who need to take advantage of even little changes in price. Because of such performance and safety within the trading environment, MEXC has been declared the go-to solution for traders ready to exploit opportunities efficiently and quickly in fast-paced scalping.

In other words, all that matters is the speed of the mind, technical analysis, and an accurate platform to determine the way one would reach the top in the 1-minute scalping strategy. One may always deploy with the likes of MEXC, given a well-framed strategy to make appropriate use of extreme speed volatility. Just refine your strategy and remain disciplined while reaping consistent profit through slight volatilities in 1-minute scalping.

To register and know more about MEXC, click on the link below:

Also read: Best Crypto Exchange With Lowest Fees

The Essentials to Consider Before Scalping: A Deep Discussion

Having spent hundreds and thousands of hours in the very trenches of trading, let me tell you that beginning trader-scalping is by no means a strategy that should be taken lightly. It is fast-paced, wild, and sometimes too much for a human brain, but simultaneously, it is wonderfully rewarding if one knows his game. Having plunged into 1-minute Scalping, I took not so long to realize that there was more to this than merely hopping into the market and hoping for the best. With time, I have found that several things make or break a scalping strategy. If you are really serious about this form of high-speed trading, here are six essential factors to consider before you start scalping.

1. Market Volatility: The Lifeblood of Scalping

The very first day that I began to scalp, the thing that was deeply rooted in my mind was the essence of volatility. With no volatility, you basically don’t have the movement that you need to make the little changes in prices that you’re looking for. In Scalping, you aren’t trying to catch a big swing or long-term move-you are trying to find those moments where the market changes enough for you to catch your little profit.

Why Volatility Matters to Me

I have found that in volatile markets, the magic happens. The moment the price swings even a few pips, I am in, take my profit, and out. It is during specific hours that the forex or crypto markets, on news releases or major events, usually see me reaping the most profitable trades. During these times, prices tend to move fast, and there are lots of opportunities to get in and out quickly.

However, if there’s no trading range and the overall profitability is almost zero, then you will feel that this is a totally flat market, which is just empty air. Believe me, I’ve squandered countless moments staring at a nothing chart, anticipating a movement that never materialized. This isn’t very pleasant. That’s why it makes sense to track down a market with high volatility and congestion times in your schedule.

“As mentioned, volatility is important, and you need to be careful when using a 1-Minute Scalping Strategy in Trading Crypto.”

Where I Find Volatility

I have been selling and buying in pairs of the EUR/USD, the GBP/USD, and the USD/JPY, and the experience that I have got is that there is enough liquidity and action as a result of which it was possible for me as a scalper to earn money. The cryptocurrency market would be a fitting recommendation, especially for Bitcoin and Ethereum, due to the inherent volatility they have over some time. Tesla, for instance, is known for being a high-volume stock, and it should be the first stock to buy. These assets are usually the ones that make me the required volatility and do not make me suffer a drastic and abrupt standstill.

What I’ve come to learn is that, if anything, you should avoid trading any periods of low volatility. This includes the middle of the night or any hours of the day when major markets are closed. These usually create flat price actions. These are periods of time in which you will be caught in a low-range market with very little opportunity for profit.

2. Liquidity: Smooth Execution

Liquidity is one thing that I never appreciated when starting to trade, but through time, I realized just how critical it is. Scalping requires fast Execution, and if there isn’t enough liquidity, then this can lead to slippage in my trades wherein my entry or exit price is different from what I had expected.

How Liquidity Impacts My Trades

The most annoying thing that can happen when I try to scalp is to have the perfect trade setup and then to see it go away with the wind because I didn’t have enough liquidity to make the trade at the price I wanted. Liquidity is the parameter that can instantly enter or leave without all the orders getting filled. The liquid market suggests that there will always be a sufficient quantity of buyers and sellers; hence, they contribute significantly to the reduction of slippage and, at the same time, make trading a smoother task for the ones involved.

To me, liquidity is about the assets I decide to trade. For me, it’s usually high-volume forex pairs like EUR/USD or GBP/USD because they are very liquid and have tight spreads with fast Execution. Every time I trade anything with low liquidity, such as a minor forex pair or a low-volume stock, I find out my trade execution is significantly late or even that my stop-loss is triggered out of the blue because of slippage.

Liquation of the Best Assets to Scalp

That’s why I stick to very liquid markets. Usually, big forex pairs and stocks from companies that see a high amount of daily trading volume, like Apple, Google, and Amazon, provide the smoothest Execution for me. Those are where I can get in and out at the price I need, so my scalping strategy is more viable.

3. Choosing a Broker: Your Partner in Scalping Success

For me as a scalper, my broker is my lifeline. Experience, with all its bitterness, taught me that a wrong broker introduces a host of issues right from delayed trade executions to hidden fees that gnaw at the profits. My early days saw a few really bad brokers, but later, after lots of trial and error, I managed to zero in on the right broker. Now, I am really choosy as to with whom I trade.

What I Look for in a Broker

When choosing a broker to scalp with, there are basically a few things that I consider important: low spreads and commissions. Scalpers, like me, make our money from tiny movements in price, and any additional costs can quickly eat into my profit. A broker with tight spreads and low commissions is indispensable if Scalping is to work for me.

Fast Execution: I am not in a position to afford any delay in Scalping. I need a broker who will offer me ultra-fast execution speed with no requotes. A difference of even a few seconds means the difference between winning and losing.

No Scalping Restrictions: Some brokers have rules that limit or outright ban scalping. I’ve learned to avoid brokers that restrict this strategy, as they can make it difficult to execute my trades as I intend.

Advanced Trading Platform: I use a platform with real-time price data, charting tools, and custom indicators. The right platform is crucial to the scalp. It enables me to pinpoint entry points quickly and execute trades without hesitation.

How to Avoid Broker Pitfalls

My second mistake at the beginning of my career was choosing a broker because they were advertising very low spreads, but then, after some time, I saw they were hitting me with hidden fees or poor Execution. I know better now: transparency is key. Always read the fine print and make sure the broker’s terms align with your scalping needs.

4. Trading Fees: How to Effectively Manage Your Costs

Scalping trades have a high level of activity, so you will often encounter these transaction costs. I’ve found that with time, this kind of cost can be truly detrimental, especially if I lose my focus. An additional plus to this, however, is that you avoid the extra charges whenever you are fully aware of the trading cost, which is the total amount of the trade inclusive of all transaction costs.

How Trading Fees Impact Scalping

With every trade I execute, there goes some cost: spread, commission, and sometimes swap fees in case of holding positions overnight, although I try not to keep them overnight. Since this is a scalping method, profits are earned with a small margin per trade; I have to ensure that my costs don’t outweigh my gains.

I found that even small increases in trading fees could make a huge difference in my account. Let’s say my goal is to get a 2-pip profit every transaction and the broker sheds a 1-pip spread plus commission, in this situation, I’m already down, so a half of my wanted profit is not even bothering me and the trade didn’t even start. This is why I’m always so selective when it comes to searching for brokers with the lowest transaction fees.

Minimizing Costs

I always take the time to figure out my breakeven point on every trade, know how much I actually have to make just to break even on my fees. If the fees charged by a broker are unrealistically high, I rapidly search for alternatives. Over time, I’ve learned that tiny tweaks in my fee setup translate into giant leaps of profitability.

5. Time Commitment: Be Prepared for a Fast-Moving Environment

You cannot just in and out of scalping whenever it feels convenient. It takes focus, commitment, and the ability to act quickly on the spur of the moment. I have found that when I am not totally dedicated to my hours of trading, opportunities are missed, and results suffer. Scalping isn’t passive trading; rather, it is active involvement and quick decisions.

The Need for Focus

To scalp properly, I must plunge fully into the market. A couple of times, I believed that I could multitask even when trading, but it was costly. You either lose some opportunities, or the worst happens: make unplanned decisions that bring about several losses. If you do not plan on sticking right on your screen and acting upon one split-second adjustment of the market, this is probably not the right technique to apply.

Time Management

What I really like about Scalping is the most volatile moments: the overlap of London and New York sessions in forex or key news events in crypto. I try to be free and concentrated during those hours so as not to miss anything. Anyway, what has worked for me is devoting blocks of time to trading and leaving all distractions aside.

6. Emotional Discipline: Keeping Calm Under Pressure

Scalping is fast, and sometimes it is downright stressful. I found myself, when beginning, caught up in the excitement of making quick profits or trying to recover from a loss. But I soon realized that emotional trading was a recipe for disaster.

Controlling My Emotions

To be a successful scalper, I have learned the necessity of emotional discipline. I have established concrete rules for my trades: I have strict stop-loss and profit targets. Besides this, it allows me to stick to my strategy in case of unexpected movement in the market. And since it does happen, the ability to resist “revenge trading” keeps me on target with my plan.

I also take regular breaks. Trading without breaks can lead to burnout and poor decision-making, so I’ve learned to step away for a few minutes to clear my head if I’ve been trading for a while. This keeps me focused and helps me maintain the level-headed approach that Scalping requires.

Top 1-Minute Scalping Strategies That Work

After years of trading, one of the lessons I’ve relished has been proving that a 1-minute scalping strategy can be fun and profitable if you do it right. I have worked through the learning curve of finding the right way and the wrong way by doing all the trial-and-error stuff. As a consequence of my consistent hard work and efforts, I have discovered some techniques that not only work but persistently generate profits, and it’s my duty to make known these secrets. This is the only article that will display alternative methods for scalping trades, the sorts that most traders never dream of. So, let’s start.

Strategy 1: Moving Average Crossover with Volume Confirmation

Step 1: Set Up Indicators

The approach I usually take when beginning is to use two Exponential Moving Averages (EMAs), which should be one of 9 EMA and the other of 21 EMA, both along with a Volume indicator to my chart. Through them, I can learn the periods during which the price moves in the same direction as it did not before, as well as the possible breakout strength.

Step 2: Identify Entry Points

When the 9 EMA is higher than the 21 EMA there is the signal to buy. When it falls below of the two, the signal is to sell. The twist on this is that I go long only when volume leaps above the average. Volume confirmation is vital as it signals that the real breakouts are going to wait a little while that the fake ones are already gone.

Step 3: Execute Trades

I execute my trades immediately after confirmation, setting a stop-loss just below the recent low for buys or above the recent high for sells. This minimizes losses when the market doesn’t cooperate.

Step 4: Exit Strategy

I always close the trade when EMAs cross back or if volume suddenly drops. Sometimes, I’ll set a profit target of 5-10 pips and use a trailing stop to capture extended moves.

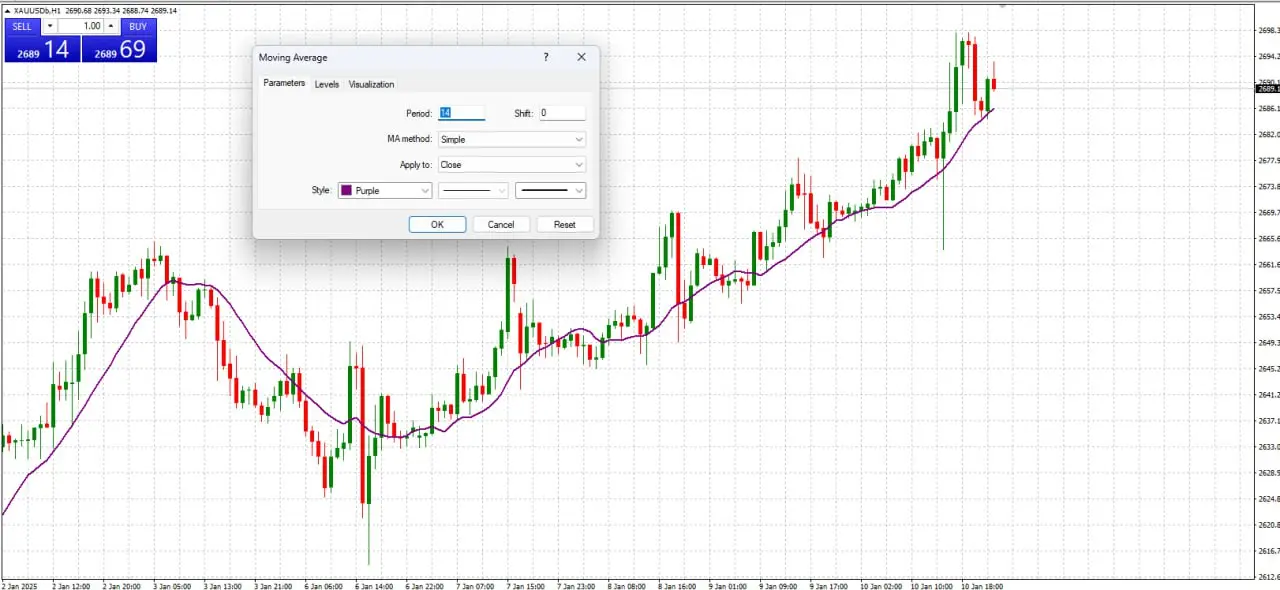

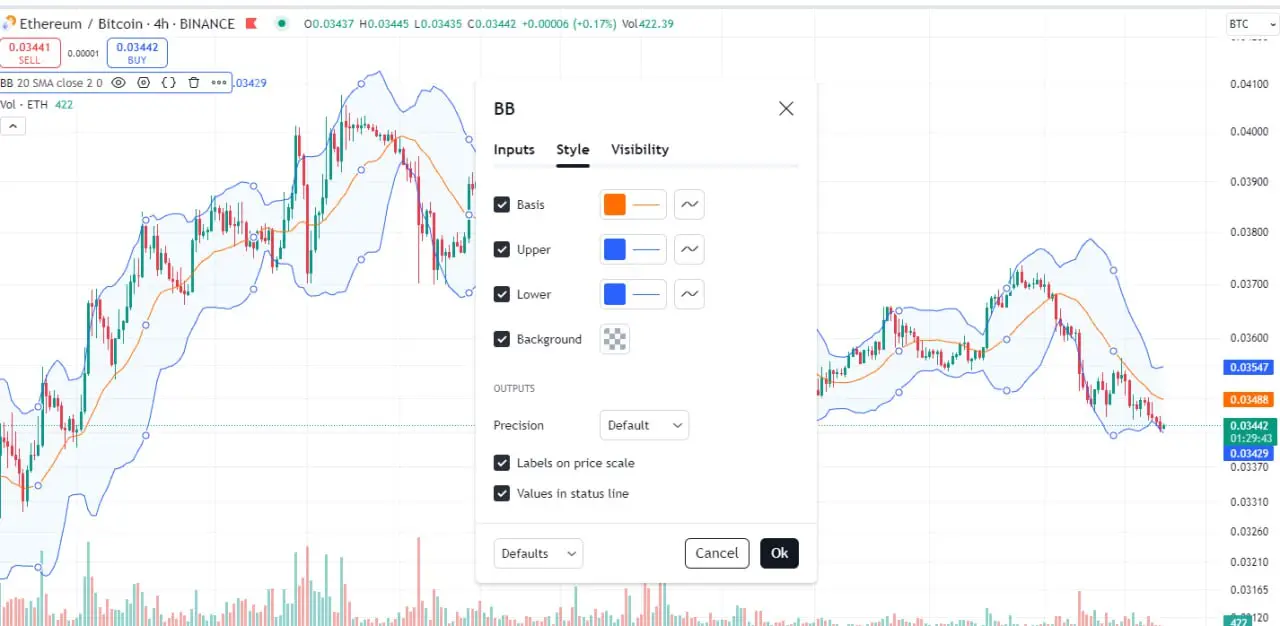

Strategy 2: Bollinger Bands Breakout with RSI Filter

Step 1: Setting of Bollinger Bands

I use Bollinger Bands set to 20-period and 2-standard deviations. These bands highlight volatility and breakout points.

Step 2: Spot Breakout Opportunities

When the price breaks above the upper band, I check the RSI. If it’s above 50, I take the buy. For sales, I wait for a breakdown below the lower band and RSI below 50. This added filter prevents chasing weak breakouts.

Step 3: Enter the Trade

I pull the trigger as soon as conditions align. Stop-losses go just outside the bands to avoid getting stopped out too early.

Step 4: Exit Strategy

I take profits as soon as the price returns to the middle band or RSI reverts to neutral (40-60 range). To lock in gains during trends, I sometimes use a dynamic trailing stop.

“For a deeper understanding and to get familiar with the best trading indicators in the crypto market, it is recommended to read the article Best Trading Indicators for Crypto.“

Strategy 3: RSI and Trendline Scalping Combo

Step 1: Set Up RSI and Draw Trendlines

I set the RSI to a 7-period for quick signals and draw trendlines on 1-minute charts to track short-term trends.

Step 2: Identify Reversals

When the RSI drops below 30 (oversold) and touches a trendline support, I look for bullish candlestick patterns, like pin bars. For sells, I wait for RSI above 70 (overbought) near trendline resistance.

Step 3: Execute Trades

I open positions immediately after confirmation, keeping my stop-loss just beyond the trendline to avoid unnecessary risks.

Step 4: Exit Strategy

Profits are taken as soon as RSI approaches 50 or the price breaks the trendline in the opposite direction. When the trend is strong, I use trailing stops to ride it further.

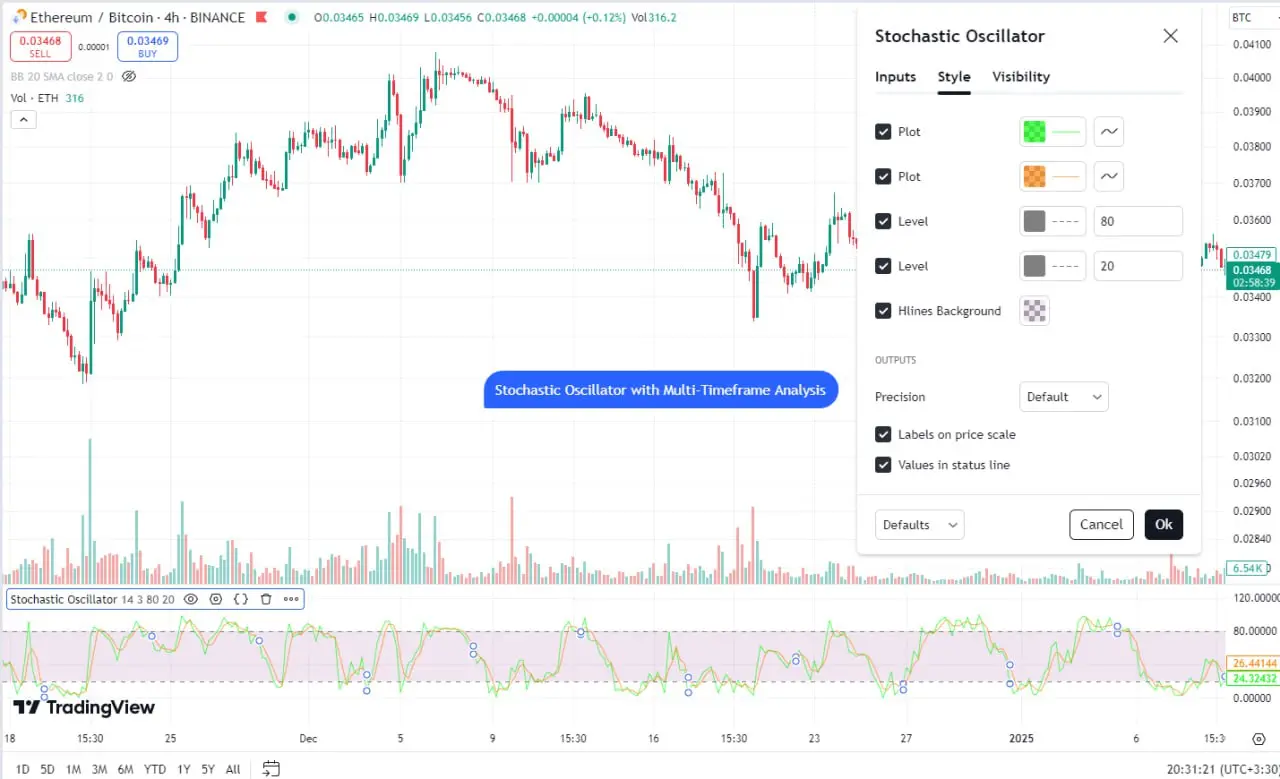

Strategy 4: Stochastic Oscillator with Multi-Timeframe Analysis

Step 1: Setting the Stochastic Oscillator

I use a setting of 5, 3, and 3 for sensitivity and always have a 5-minute chart open beside my 1-minute chart. This keeps me one step ahead in the game.

Step 2: Identify Trade Signals

I am trading with a clean mind once the

Stochastic low on the 5-minute chart and the bullish crossover south of 20 on the 1-minute chart have been detected. For that, I let a sell signal overbought on the 5-minute chart and a bearish crossover above 80 on the 1-minute chart appear.

Stochastic low on the 5-minute chart and the bullish crossover south of 20 on the 1-minute chart have been detected. For that, I let a sell signal overbought on the 5-minute chart and a bearish crossover above 80 on the 1-minute chart appear.

Step 3: Enter the Trade

Once signals align, I enter trades with a tight stop-loss, relying on the higher timeframe to confirm direction.

Step 4: Exit Strategy

I take profits as soon as the Stochastic on the 1-minute chart exits overbought or oversold zones, keeping risk minimal.

Tips for Maximizing Profits with Scalping

- Track Market Sessions

I always trade during high-volume sessions, such as the London or New York open, where volatility is highest. - Use Level 2 Data

Level 2 market data gives me insight into order flow and liquidity, helping me anticipate moves before they happen. - Limit Trading to News-Free Periods

I avoid scalping during major economic announcements, where price spikes can blow through stop-losses. - Experiment with Time Intervals

Sometimes, I shift to 2-minute or 3-minute charts if the 1-minute timeframe feels too erratic. - Master the Art of Scaling In and Out

Instead of going all-in, I scale into positions as confirmation strengthens and exit in parts to lock in profits gradually. - Keep a Trading Journal

I document every trade, noting what worked and what didn’t. Reviewing my journal has been instrumental in fine-tuning my strategies.

Risk Management for Scalping Success

I have learned it the hard way: risk management in Scalping is not a safety net but the backbone. In the beginning, I was chasing profits without protecting my capital, and let’s just say the results weren’t pretty. With time, I refined my approach, and now I’m here to share my four-step formula for managing risk effectively while scalping.

Step 1: Define Your Risk Per Trade

When I first started scalping, I treated every trade as an isolated opportunity. Big mistake. I quickly realized that surviving long-term means capping losses. Now, before I even place a trade, I define my risk per trade as a percentage of my account—usually 1% or less.

Why it works:

By risking only a small portion of my account, I know that even a string of losses won’t knock me out. Besides, it keeps me emotionally detached because I know I’m not overexposed.

My approach:

- I calculate the dollar amount I’m willing to risk based on my total account size.

- I adjust my position size rather than widening my stop-loss to fit the market.

- I never allowed the feelings to push me toward increasing my risk after a winning streak. Consistency is the key.

Step 2: Use Tight Stop-Losses and Trailing Stops

If there is anything I have gotten right, then it is in using tight stops. Scalping is a game of exactitude; I just can’t let a losing trade overstay its welcome. I always put stop-loss orders at the same time as the actual entry of the position. For added security, I would usually employ trailing stops to secure my gain.

Why it works:

Tight stop-losses minimize drawdowns while trailing stops let me ride trends without giving back too much profit.

My approach:

- I base stop-loss placement on technical levels, such as recent support or resistance zones.

- I avoid arbitrary stop-losses and let price action guide my decisions.

- For trailing stops, I set increments that balance profit capture with volatility to prevent premature exits.

Step 3: Manage Leverage Wisely

Leverage works both ways in the game of Scalping. Earlier in my experience, I had fallen into that trap of over-leveraging to increase profits, only to see losses shoot up in the same manner. Now, I use leverage as a tool-not a crutch.

Why it works:

Scaling back on leverage helps me maintain control over trades, especially in fast-moving markets.

My approach:

- I never exceed 10:1 leverage, even when market conditions seem favorable.

- I focus on high-probability setups instead of chasing every potential trade.

- I use demo accounts to test leverage settings before applying them in live trades.

Step 4: Assess Performance and Adjust

The biggest lesson I have learned is that risk management is not static. Markets evolve, and so should my strategies. I track every trade meticulously, analyzing what worked and what didn’t. It’s a continuous improvement process, and that has been a game-changer.

Why it works:

Evaluating performance helps identify patterns, weaknesses, and opportunities for optimization.

My approach:

- I keep a trading journal that records entry/exit points, risk levels, and outcomes.

- I review my trades weekly to spot trends and refine my approach.

- I adjust my risk parameters when market volatility changes, ensuring I stay ahead of the curve.

Additional Tips for Bulletproof Risk Management

- Predefine Maximum Daily Loss Limits

I set a maximum daily loss limit to avoid revenge trading. Once I hit it, I walk away and reset. - Diversify Trading Instruments

Instead of relying on a single asset, I spread trades across different instruments to reduce correlation risks. - Avoid News-Driven Volatility

Economic events can create erratic price movements. I check economic calendars religiously and avoid trading during major announcements. - Use Break-Even Stops

The minute a trade moves in my favor, I move my stop-loss to breakeven. It’s like having a safety cushion without sacrificing upside potential. - Simulate Scenarios Before Going Live

Before implementing any new technique, I simulate it on demo accounts. This helps me fine-tune my methods without risking real money. - Plan for Slippage

Slippage can be a silent killer in scaling. To minimize this risk, I choose brokers with tight spreads and fast execution speeds.

Common Errors to Avoid in Scalping

From the beginning up to now, I have made many mistakes that have been associated with Scalping, some of which are costly and extremely frustrating. But for each one of them, I got a lesson that the trading of today is based on. I am exchanging this information with you so that you can avoid the possible dangers and proceed more effectively. The following are four common mistakes committed by scalpers and how you can deal with them.

Step 1: Overtrading Without a Plan

Initially, when I started the process of Scalping, I was literally tied to my computer, taking the trade one after another. In my vision, the more trades a person makes, the more profits would be gained. Not at all. The excess of trades forced me to set up false ones that did not exist, leading to unnecessary losses.

Why it’s a problem:

Overtrading drains focus, increases transaction costs, and amplifies emotional stress, making it harder to stick to your strategy.

How I fixed it:

- I established a clear trading plan with predefined entry and exit rules.

- I set a daily trade limit to avoid impulsive decisions.

- I focus on quality over quantity, choosing only high-probability setups.

Pro tip:

I also use timers to remind myself to step away and take breaks. Scalping demands focus, and burnout leads to mistakes.

Step 2: Ignoring Spread and Commission Costs

Early on, I underestimated how much spreads and commissions could eat into my profits. Since Scalping involves frequent trades, even a small fee per trade adds up quickly.

Why it’s a problem:

High costs reduce net profits, especially when aiming for small gains. Many traders fail to account for this and overestimate their returns.

How I fixed it:

- I switched to a broker with low spreads and competitive commissions.

- I calculated my breakeven point before entering trades to ensure the reward justified the cost.

- I optimized my position size to balance risk and reward effectively.

Pro tip:

Look for brokers offering ECN accounts for tighter spreads and faster Execution—this made a big difference in my results.

Step 3: Chasing Trades and Abandoning Strategy

One time, I used to panic if I missed the right opportunity. I would join late trades in an attempt to grab at least a little bit of a move, but in most cases, that would end in a loss.

Explaining why it’s an issue: Though chasing trades can result in poor entry points, which increase risks and decrease profit potential, it is also a sign of excitement rather than following a planned approach.

How I fixed it:

- I learned to accept missed opportunities and focus on the next setup.

- I stuck to my predefined criteria and avoided trades that didn’t fit the plan.

- I used alerts and automated tools to avoid staring at the screen and reacting impulsively.

Pro tip:

I keep a checklist by my desk. Before placing any trade, I make sure all the conditions are met—no exceptions.

Step 4: Neglecting Risk Management

At the beginning, I really thought Scalping was all about speed and precision. Of course, it is, but how important risk management was really didn’t click until after I took some big losses.

Why it’s a problem: Failing to manage your risk means that one bad trade can wipe out several small gains, defeating the purpose of scalp trading altogether.

How I fixed it:

- I implemented strict stop-loss orders for every trade.

- I used a 1:1 or 2:1 risk-to-reward ratio to ensure profits outweighed losses.

- I scaled down position sizes during volatile periods to reduce exposure.

Pro tip:

I also set a daily loss limit. If I hit it, I stop trading and analyze what went wrong rather than trying to recover losses emotionally.

Bonus Mistakes and Solutions

1. Trading During Low Liquidity Hours

In the first steps, I ignored the specific points about trading sessions and very often entered trades during quiet market periods. The disappearance of liquidity led to position changes and unpredictably worsening prices.

2. Failing to Adapt to Market Conditions

I used to stick to the same strategy regardless of market changes. This rigidity led to poor performance in sideways or choppy markets.

Solution:

Now, I analyze market conditions daily and adjust my approach—scalping aggressively during trends and being more conservative during consolidations.

3. Overlooking Technical Tools

I once relied solely on price action, ignoring indicators that could confirm setups. This caused me to miss signals and second-guess trades.

Solution:

All of the indicators I use—moving averages, RSI, and Bollinger Bands—require me to trade with a higher degree of faith.

4. Emotional Trading and Revenge Trades

After suffering a loss, I made the mistake of not sitting out the subsequent trade and instead making instant decisions, hoping to cut the loss fast. Instead, I used to be in the red most of the time.

Solution:

I take a step back after a loss, review what went wrong, and only re-enter when a proper setup aligns with my strategy.

Conclusion

The journey of Scalping was one of the most personalized and remarkable adventures I’ve had in the trading world. As a technique, it is a combination of quick thinking, specified targets, and adherence to rules; however, when approached the right way, it can produce awe-inspiring results and even be a stepping stone for economic security. According to the analysis, strategy and planning lay the foundation of efficient Scalping. In my case, the usage of time-tested learning tools, as well as the study of patterns and the comprehension of the entry and exit strategy, have resulted in me being the first to make a move in the market.

The risk management element has been a must. It is simple to throw away all the profits (if any) by placing wrong stop-loss orders and setting unrealistic profit targets. I have come to understand that the way to go is to protect the funds and follow techniques that promote stability instead of short-term profits. As much as discipline is, another part is emotional control, which means avoiding panic during losses and being humble during success.

Scalping is not so much about opportunism anymore; it is a direction in the art of growth, the lessons of oversight, and survival. The market is dimmed, yet with the proper knowledge and as much experience as you can gradually accumulate, you can create guides that will withstand whatever fluctuates. Whether you are a beginner or a professional looking to improve your art, always go the right way and go to the conferences and conventions that will keep you at the center of the financial markets. If you work hard and more slowly but permanently, you will be able to escape from the high-energy people, which will give you trading opportunities, and thus, you will improve your method.

.